BlackRock on Tuesday announced the purchase of the ports at the Panama Canal that President Donald Trump raised security concerns regarding their connections to China.

BlackRock announced the $22.8 billion deal with CK Hutchison’s subsidiary Hutchison Port Holdings, which will see the firm acquire the Panama ports of Cristobal and Balboa, which are located at the Atlantic and Pacific ends of the canal, respectively. It will also acquire Hutchison’s controlling interest in 43 ports in 23 other countries.

The world’s largest asset manager will partner with Terminal Investment Limited (TiL) to operate the ports in concert with the BlackRock subsidiary Global Infrastructure Partners (GIP).

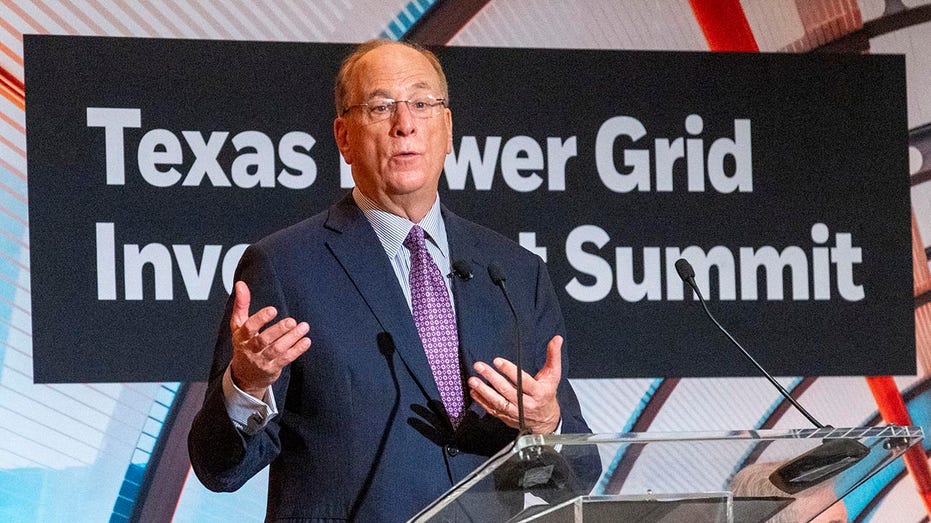

“This agreement is a powerful illustration of BlackRock and GIP’s combined platform and our ability to deliver differentiated investments for clients,” BlackRock chairman and CEO Larry Fink said. “These world-class ports facilitate global growth. Through our deep connectivity to organizations like Hutchison and MSC/TIL and governments around the world, we are increasingly the first call for partners seeking patient, long-term capital. We are thrilled our clients can participate in this investment.”

TRUMP FLOATS IDEA OF US RECLAIMING PANAMA CANAL

Before his return to the White House, Trump claimed in a social media post on Christmas Day that Panama’s government allowed “wonderful soldiers of China” to “lovingly, but illegally” operate the Panama Canal – a statement that the Panamanian and Chinese governments denied.

Chinese companies have increased their investment in Panama in recent years, including at facilities related to the canal, such as a terminal for cruise ships and a bridge that’s planned to be built over the canal. The presence of those firms has sparked geopolitical concerns given the government of China’s ability to control Chinese companies to advance strategic goals.

CK Hutchison has operated the ports at Balboa and Cristobal since 1997. The company is headquartered in Hong Kong, which the Chinese Communist Party controls.

RED SEA, PANAMA CANAL ISSUES ARE WORSE THAN PEOPLE REALIZE, EXPERT SAYS

CK Hutchison co-managing director Frank Sixt said the transaction was the “result of a rapid, discrete but competitive process in which numerous bids and expressions of interest were received” and added that the deal should deliver cash proceeds in excess of $19 billion to the group.

“I would like to stress that the transaction is purely commercial in nature and wholly unrelated to recent political news reports concerning the Panama Ports,” Sixt added.

The deal, which is still subject to regulatory approval, will also see BlackRock’s consortium acquire a total of 43 ports, comprising 199 berths in 23 countries, from Hutchison Port Holdings (HPH). The transaction includes HPH’s management resources, terminal operating systems and other assets related to the control and operations of the ports.

The press release doesn’t list which ports are involved in the port deal or the countries in which they’re located, through it does specify that it doesn’t include the HPH trust, which operates ports in Hong Kong, Shenzhen and South China, or any other ports in China.

Read the full article here