Images by GettyImages; Illustration by Bankrate

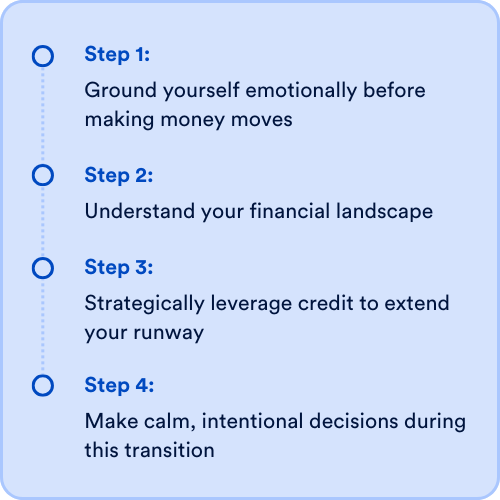

Unemployment can be disempowering both emotionally and financially. The uncertainty of not knowing when your next paycheck will arrive can disrupt your sleep, strain your relationships and trigger spirals of anxiety and fear. That’s why learning how to leverage debt strategically can offer the breathing room you need to job search on your terms — without panic or desperation.

But before you start swiping credit cards or applying for new ones, there’s a process to follow — and it doesn’t begin with your bank account. It begins with your emotional state.

EXPAND

Step 1: Ground yourself emotionally before making money moves

When money is tight, it’s natural to feel anxious, fearful or even ashamed. These feelings are valid. What matters is how you respond to them. If you try to ignore or only push through them, you might end up making reactive decisions that compromise your financial future.

Instead, make yourself feel safe enough to process those negative emotions. Remind yourself repeatedly that this situation is temporary, you will figure out how to get through it. You’re not failing, you’re transitioning.

In order to create this sense of safety, you want to be intentional with your self-care:

- Protect your sleep, move your body and nourish yourself. Your physical self-care routines will help regulate your emotions. And when you regulate your emotions, you send a signal to your nervous system that you’re safe enough to slow down and think intentionally.

- Connect instead of isolate. Reach out to people you trust. Your community may not only offer emotional support but also job leads, reference or freelance opportunities.

- Schedule joyful breaks. Whether it’s watching your favorite show, coloring or spending time with loved ones — intentionally set time aside for activities that refill your emotional cup. Joy will prevent job search overwhelm and avoidance from creeping in.

Step 2: Understand your financial landscape

Once you feel emotionally grounded, it’s time to look at your numbers with compassion and curiosity.

Start by listing all your monthly expenses in two categories:

- Fixed

-

These will stay the same each month and include your rent, car payments and subscriptions.

- Variable

-

These change from month-to-month and include costs for groceries, gas and utilities.

Then, categorize each of these expenses into two buckets:

- Cash-only expenses

-

Must be paid with cash or direct debit.

- Credit-eligible expenses

-

Can be paid with a credit card.

Now, look at how much cash you have saved and calculate how long it can cover your cash-only expenses. For example, if you have $5,000 saved and your cash-only expenses total $2,500 per month, you know you have two months of cash runway.

This exercise gives you a clear picture of your current financial runway and what you’ll need to navigate the upcoming months.

Step 3: Strategically leverage credit to extend your runway

Once you’ve mapped out how far your cash will take you, consider using credit as a tool — not a trap. Specifically, look into using credit cards with intro offers.

Search for credit cards with a 0 percent APR for 15 months or more. These offers often require a good credit score — typically 670 or higher — so check your score before applying.

If you’re approved:

- Use this new credit only for your credit-eligible expenses to preserve your cash.

- Write down which items you’ll charge to this card and how many months it will stretch your runway.

- Aim to use no more than 30 percent of your total credit limit to protect your credit score.

Money tip:

The goal here is not to spend recklessly — it’s to stretch your resources with intention, so you’re not forced into a rushed or misaligned job decision.

Step 4: Make calm, intentional decisions during this transition

With a clear view of your finances — cash, expenses and credit access — you now have a solid foundation to make thoughtful choices. Difficult decisions will be made easier when you have the big picture in place.

- Maybe you pick up part-time work to supplement your cash flow.

- Maybe you realize you can’t afford to wait three or four months before accepting your next job offer.

- Maybe you set a timeline for when to follow up on leads, update your resume or launch a side hustle.

Whatever decisions you make, let them come from a grounded place, not from panic. This season is an invitation to reset. You have a chance to reflect on the kind of work you want to do, how you want to feel in your next role and how you want to live moving forward.

Keep in mind:

You’re not just unemployed. You’re in a life transition — one that can be empowering, intentional and even transformative.

Don’t spiral — strategize

Yes, debt has risks. But it also offers opportunity — especially when used with intention. Ideally, you’ll secure a new job and pay off your balance before the 0 percent promotional period ends. But if that’s not your reality, don’t panic.

If interest kicks in before the balance is paid off, return to your debt payoff plan and keep going. Instead of viewing the interest as a setback, consider it a service fee for flexibility that allowed you to stay grounded, avoid misaligned decisions and protected your well-being during a challenging time.

Unemployment doesn’t have to mean chaos or crisis. With emotional regulation, a clear financial plan and the strategic use of credit, it can become a time of transformation.

Read the full article here