Getty Images, MesquitaFMS

The August 1 deadline for the latest round of trade negotiations has passed, and drivers remain in insurance purgatory — waiting to see how tariffs will impact auto rates and repair costs. The U.S.-EU trade agreement may bring some stability to the global auto market, but it also solidifies another thing: tariffs are here to stay.

Even in the face of tariffs, the same key principles apply when reviewing your auto policy. By treating car insurance as part of a larger financial strategy, drivers can take steps to reduce premiums and better prepare for the rising cost that may be hard to avoid.

1. Review your coverage and discounts

Bankrate’s Tariffs and Inflation Consumer Sentiment Survey found that more than two-thirds (or 65 percent) of Americans believe tariffs will worsen their personal finances. But even in the face of economic stress, the tried and true ways to save money on car insurance still apply — make sure your policy details are accurate, apply for discounts, and eliminate coverage you don’t need.

However, with tariffs driving up the cost of everything from replacement parts to towing, it’s worth rethinking what counts as “unnecessary.” For example, dropping policy add-ons like rental car reimbursement — which covers the cost of a rental car while your vehicle is being repaired after a covered claim — can be a smart move if you have another car or live in a walkable city. But if you only have one car at your disposal to commute to work, run errands or shuttle your kids to school, you may want to rethink this move.

As rental car companies acquire and maintain vehicles under the new tariff plan, those added costs are passed directly to customers. These insurance add-ons may become more valuable as the out-of-pocket costs for these services increase.

Insurance discounts can help offset rising costs, but not all of them deliver the same long-term value. Some carriers offer generous new business discounts when you switch providers, but those savings may only last the first six to twelve months. In some cases, the loyalty or legacy discounts with your current insurer may be a better deal in the long run.

If you’ve avoided some of the more involved savings opportunities, like defensive driving or telematics, now may be the time to reconsider. Depending on your state, the defensive driving course can take 4-8 hours to complete, but can save you up to 20 percent on certain coverage types. Since the discount usually lasts for three years, it might be worth the time commitment.

2. Think about how you might need to use your auto policy

From June 2023 to June 2025, the average cost of car insurance increased by over 30 percent. Tariffs are likely to drive insurance costs even higher for 2026. When prices of everyday items are rising all around us, it can be tempting to reduce your auto insurance coverage to save money. But that quick fix could cost you more in the long run.

If you haven’t thought about the liability and medical limits on your auto policy in the past few years, you may be underinsured. Rising healthcare costs could mean that the liability limits on your policy may no longer stretch as far as they used to. Tariffs and supply chain interruptions can impact the cost of medical equipment, supplies, medication and more. All of which eats up your policy coverage, potentially leaving you on the hook for high out-of-pocket expenses.

Increasing bodily injury liability is one of the cheaper changes drivers can make to their policy. Drivers who bump up their bodily injury liability coverage from $50,000/$100,000 to $100,000/ $300,000 only pay about $10 more per month on average.

One of the most popular bits of insurance advice is to increase your collision deductible to save on premiums. While that advice may still work for many people, pause and think about your cash flow before making any changes. That strategy only works if you actually have money in your emergency savings account.

Bankrate’s Emergency Savings Report found that nearly 1 in 4 (24 percent) of Americans have no emergency savings at all. If money is tight, talk to your agent about choosing a lower deductible, so you’re not stuck in a tough spot later. Sometimes it’s easier to absorb a slightly higher monthly premium than to scramble for a large lump sum after an accident.

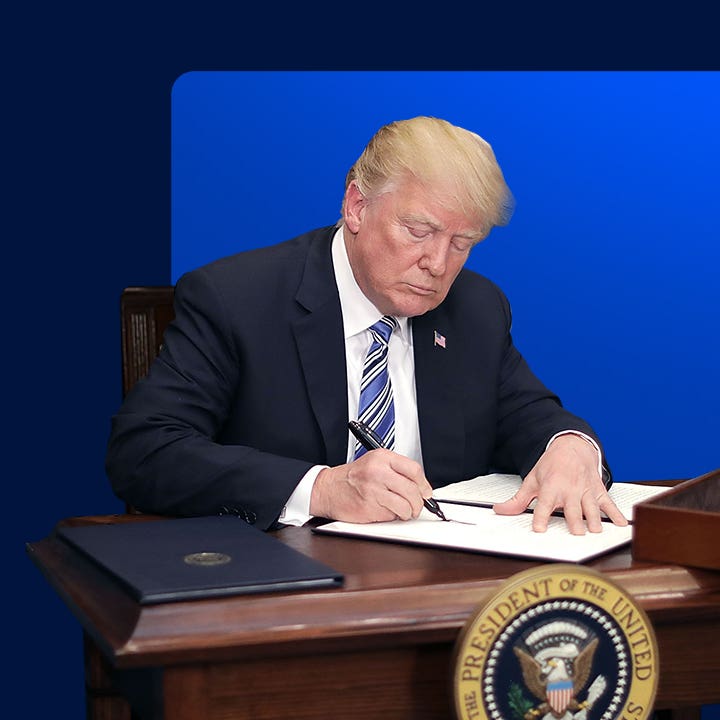

How Trump’s proposed tariffs could affect auto insurance

Auto insurance will feel a delayed impact of tariffs as rates respond to rising vehicle and repair prices.

Read more

3. Consider insurance costs before buying a new car

You may be tempted to panic buy that new ride before tariffs kick in, but unless you already had a new car in your short-term financial plan, don’t rush out to the dealership. Insurance costs are usually higher for new cars than older models, because they have a higher value and cost more to repair. If you are in the market for a new car, comparing sample quotes for a wide range of makes and models can help you accurately budget insurance costs into the price of your new vehicle. For example, the average cost of full coverage insurance for a BMW X3 is 74 percent higher than the same coverage for a Subaru Outback as of August 2025.

Many drivers are choosing to hold on to their vehicles longer to avoid taking on new loan payments. If you’ve always leased, it might be worth stepping back and comparing the long-term financial impact of leasing versus owning. Leasing often comes with lower monthly payments, but also includes added requirements like higher liability limits and gap insurance, costs you might want to avoid with a traditional loan.

Buying your leased vehicle is one option. Often, your buyout price is locked in when you sign the lease, and it’s likely below today’s used vehicle prices. This can be a cost-effective option if your leased vehicle is in good condition with low mileage.

— Brittany Howard, Bankrate loans writer

Bottom line

It may feel like tariffs are throwing a wrench in your financial plans, but the core insurance principles remain the same: make sure you have the right coverage, ensure your policy fits your budget and consider how your insurance policy would serve you if you had to file a claim. With the cost of vehicles, repairs and medical care expected to rise, now’s the time to review your policy. Increasing certain coverage limits and exploring add-ons you may have overlooked could offer stronger financial protection in a more expensive world.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here