Key takeaways

- Secured loans require collateral, in the form of a valuable asset, to back the loan.

- Lenders may offer lower interest rates and larger loan amounts for secured loans.

- Common examples of secured loans are auto loans, mortgages and some types of business financing.

- A lender can repossess the collateral if you default on a secured loan, which means more risk for you if you fail to repay.

With every loan distributed, lenders take a risk on whether the borrower will pay it back. To help mitigate that risk and insure the loan, a lender may offer secured loans.

Secured loans are typically easier to qualify for and have lower interest rates because they pose less risk to the lender. They can, however, pose a risk to you if you don’t make your payments. Before you put your assets at risk, it’s important to understand what a secured loan is, how it works and what you stand to lose by taking one out.

What is a secured loan?

A secured loan is a debt product backed by an asset you own that the lender may seize if you don’t uphold your loan obligations.

There are several types of secured loans, including mortgages, auto loans and some personal loans. Different collateral may be required depending on the type of loan or the loan’s purpose.

For example, an auto loan will require the car you’re purchasing to be used as collateral, while a mortgage will use the home you’re purchasing. A secured personal loan used to purchase an RV may require the RV you’re buying to be the asset used to secure the loan.

How does a secured loan work?

Most secured loans are installment loans, meaning you receive all your funds at once and make equal monthly payments until the loan is paid in full. Interest rates are typically fixed, and repayment terms may be as short as one year for a secured personal loan or as long as 30 years for a mortgage.

You can pledge your car, home or other asset as collateral for a secured loan, and the lender will place a lien on that asset until the loan is repaid. If you default, the lender can claim and sell the collateral to recover the loss.

What can be used as collateral for a secured loan?

What you use as collateral will likely depend on whether your loan is for personal or business use. Some examples of collateral include:

- Real estate, including equity in your home

- Cash accounts

- Cars, boats, RVs or other vehicles

- Machinery and equipment

- Investments

- Insurance policies

- Valuables and collectibles

Remember, you could lose these assets if you default on a loan, so make sure you are in a good financial place and can pay back your debt before you take out a loan.

Secured loans vs. unsecured loans

If you’re trying to decide between a secured or unsecured loan, it’s helpful to understand which one works better in various situations. Choosing one or the other often comes down to how much you need to borrow, what you need the money for, how quickly you need it and whether you meet the qualifying requirements.

| Secured loans | Unsecured loans | |

|---|---|---|

| You want a lower rate or have bad credit |

✔ |

|

| You need to borrow a large amount of money |

✔ |

|

| You need a long repayment term or lower monthly payments |

✔ |

|

| You need emergency loan or fast funding for other reasons |

✔ |

|

| You don’t want to risk losing an asset |

✔ |

|

| You want more flexibility when using your loan |

✔ |

|

| You want to consolidate your debt without collateral |

✔ |

Types of secured loans

You may be able to get a secured loan using any asset with sufficient, verifiable value that you can prove you own, assuming you meet the lender’s eligibility requirements. Most secured loans fall into a few categories.

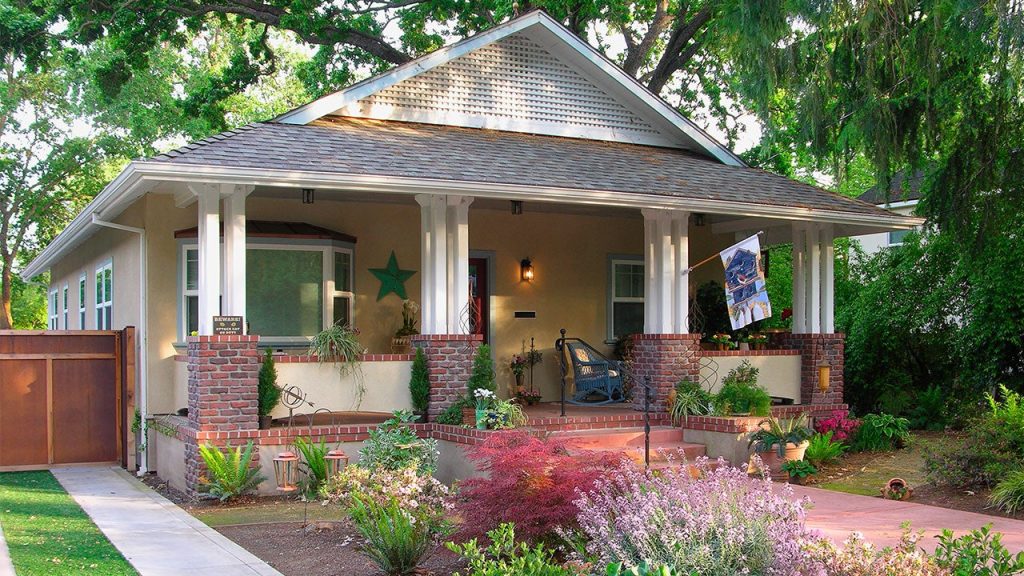

- Mortgages: With a mortgage, you put your home or property up as collateral for financing. If you fail to pay as promised, a lender can take your home to satisfy the debt.

- Home equity lines and home equity lines of credit (HELOCs): A home equity loan or HELOC allows you to borrow a portion of your home’s equity through a lump sum or revolving credit line that works like a credit card. Like a mortgage, these loans require you to put your home up as collateral.

- Auto loans: When taking out a loan to pay for a car or any other vehicle, your vehicle is used as collateral. If you don’t make the payments on time and in full, it could be repossessed.

- 401(k) loan: If you have money vested in a retirement account through your employer, you may be eligible to borrow against some of its value with a 401(k) loan.

- Loan for land: A land loan is used to finance the purchase of land. This type of loan uses the land itself as collateral.

- Business loan: A secured business loan can be used to buy equipment, pay wages or invest in business projects. There are many assets you can use as collateral, including inventory, equipment or your land or building.

- Personal loan: Some personal loan lenders offer personal loans that use the financed item, like a boat or RV, as collateral. Some lenders, like Best Egg, may provide secured loans for any purpose using assets like fixtures in the home, including cabinets and vanities.

Pros and cons of secured loans

Secured loans offer many advantages, like potentially lower interest rates, but they also have some risks.

Pros

- May be easier to get with lower credit score.

- Potential to get higher loan amount.

- Lower average rates than unsecured loans.

- Longer repayment terms.

Cons

- Risk of losing your asset if you fail to repay loan.

- Value of your collateral determines loan amount.

- Application process may be longer for secured loans.

Applying for a secured loan

The process of applying for a secured loan will vary depending on what type of secured loan you need. Home loans are the most involved, requiring a deeper dive into your employment, assets, credit history and the value of the home you’re buying or refinancing, which requires a home appraisal.

Secured car, boat and RV loans require less paperwork, and can often be approved relatively quickly. Secured personal loans work similarly to vehicle loans and require that you prove the value and ownership history of the asset you’re using as collateral for the loan.

During the application process, the lender checks your credit score and estimates the value of your collateral to determine whether you qualify. Before you submit a complete loan application, some lenders will allow you to prequalify for a loan to check rates without harming your credit.

Bankrate insights

No matter the type of loan you’re applying for, it’s important to compare lenders to find the best rate and fit for your situation. To make comparison easier, online marketplaces like Bankrate can show you information on several lenders all on one page. See interest rates, repayment terms and the pros and cons of each lender all in one place.

Secured loans and default

If you default on a secured loan, the lender can begin the process of repossessing the asset attached to the loan. It can take several months, and the lender may offer various options to help you if you have financial problems.

If you lose an asset due to repossession or foreclosure, you may still owe money on the debt if the repossessed asset doesn’t sell for enough to cover the amount of your loan. Depending on your state, a lender can sue you in court for a deficiency judgment, creating a public record that stays on your credit report for up to seven years.

However, since it often takes longer to sell a home or business asset, you may have more time to catch up on payments and avoid losing the attached collateral. For example, it could take up to one year for a lender to complete the foreclosure process.

How to avoid defaulting on a secured loan

The best way to avoid defaulting on a loan is by being proactive. Before taking out the loan compare lenders to see what’s most affordable. Get prequalified with a few different lenders to get offers based on your financial information.

Bankrate’s take:

To see your estimated monthly payments, plug your prequalification numbers into an online loan calculator. Bankrate features different financial calculators based on the type of loan and your financial goals.

Once you have your estimated monthly payment, see how it fits into your budget. Will you be living paycheck-to-paycheck with this new loan payment? Are there places in your budget you can make room for another payment?

To keep yourself safe from unexpected expenses or job loss, have an emergency fund to help cover a few months of living expenses and required debt payments.

While preparation is key, you may find yourself in a tough spot after you’ve already taken out the loan. When that happens, there are a few steps you can take.

What to do if you can’t repay a secured loan

If you’re having difficulty repaying a secured loan, and you’re at risk of default, taking action and being transparent with your lender is key.

- Contact the lender: Contact your lender to discuss your options. The lender may agree to modify your loan terms, including a new payment schedule, new repayment term or temporarily pause payments via loan deferment.

- Seek financial help: You can reach out to a U.S. Department of Housing and Urban Development-approved counselor or a consumer credit counseling agency certified by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Prioritize your bills: Always focus on paying secured debts that could affect your basic needs. For example, if you must choose between making credit card and car payments, choose the car payment.

Bottom line

A secured loan can be a cost-effective financing option if you buy a high-value asset, like a car or home. Before applying for one, weigh the benefits against the drawbacks.

An unsecured loan may be a better choice if you don’t want to risk losing collateral, while a secured loan may come with better rates. Regardless of your decision, compare offers from several lenders to get the best deal for your financial situation.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here