Images by Getty Images; Illustration by Issiah Davis/Bankrate

Key Takeaways

Key takeaways

-

A FICO score below 580 or a VantageScore of less than 601 is considered a bad credit score.

- If your score falls in the bad credit range, you will face less favorable outcomes with lenders (who may charge you higher interest rates), landlords (who could deny you housing) and possibly prospective employers (who might reject you for a job).

- You can improve your score in various ways, such as making on-time payments and becoming an authorized user on the credit card account of a friend or family member with good credit habits.

Whether you’re applying for a personal loan or taking out a mortgage, having bad credit makes many everyday financial activities more complicated. Those with bad credit might find it harder to qualify for a credit card or get stuck with lower credit limits and higher interest rates if they are approved — something that could quickly make life unaffordable if they have to carry a balance from month to month. It can even prevent you from getting a new job.

A FICO (Fair Isaac Corporation) score below 580 is considered a bad credit score, meaning it falls in the poor credit range. Along the same lines, a bad score using the VantageScore model is below 601 — which would belong in the poor or very poor credit ranges. Lenders often refer to scores in these ranges as “subprime.”

Here, we’ll break down what it means to have a bad credit score as well as the impact it could have on your life and what you can do to fix it.

What is a bad credit score?

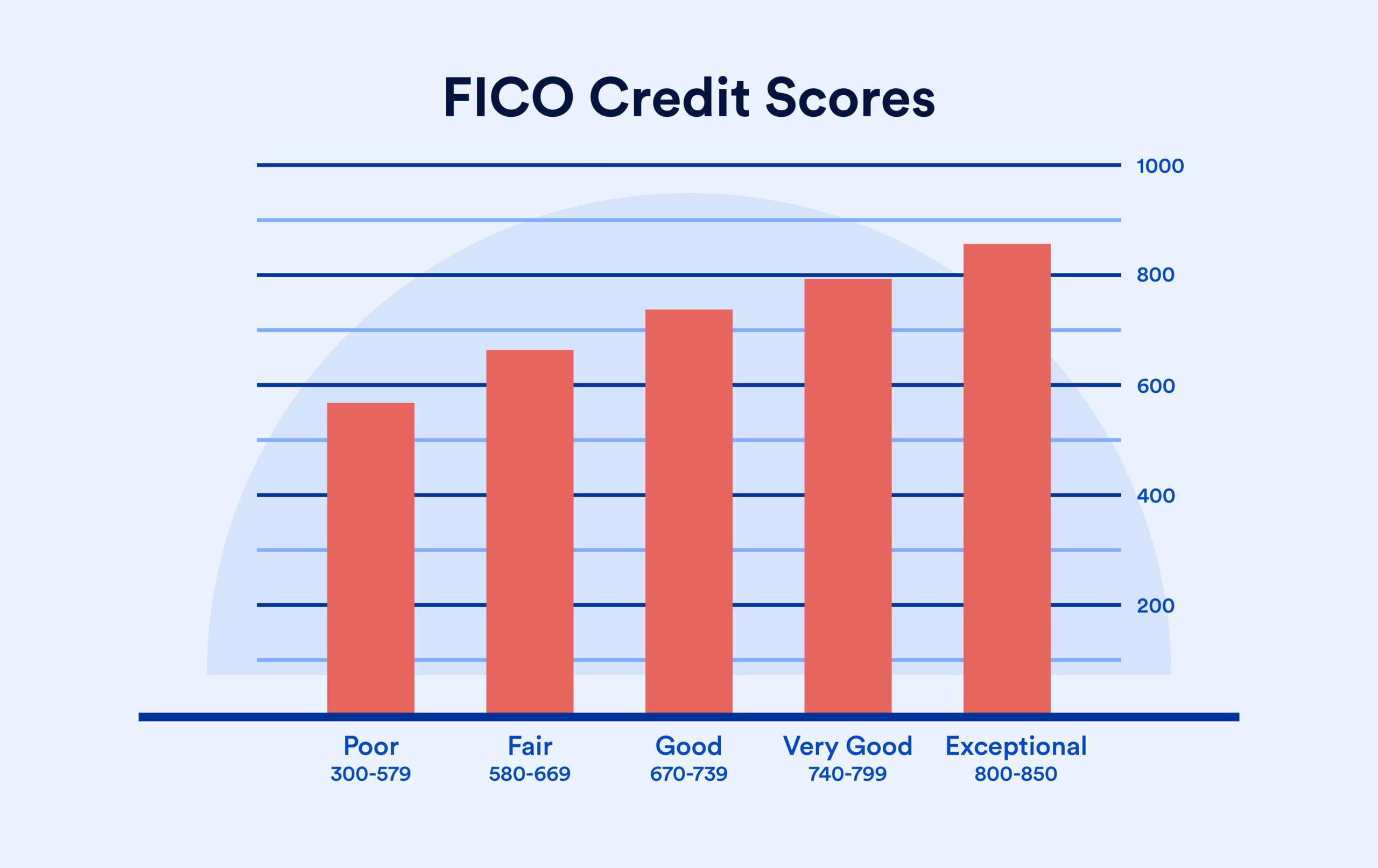

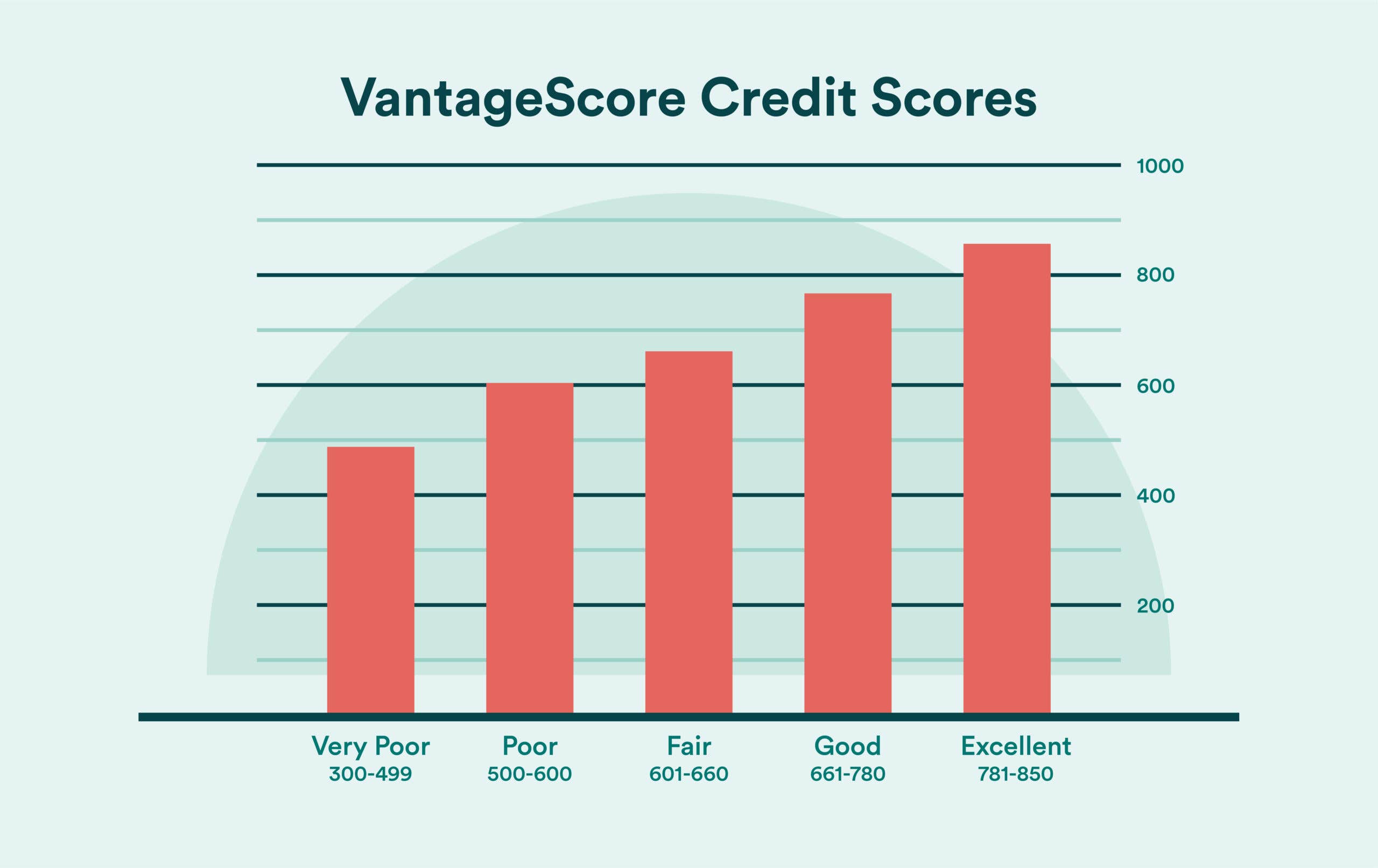

There are two widely used credit score types: FICO and VantageScore. While both scoring models use a credit spectrum ranging from 300 to 850, their credit scoring ranges differ.

What is a bad FICO credit score?

In the FICO scoring model, scores range from 300 to 850. This number is designed to signal to potential lenders how risky a particular borrower is. If your credit score lands in the range of 300 and 579, it is considered poor, and lenders are more likely to see you as a risk.

Here’s how the FICO credit scoring system ranks credit scores:

EXPAND

In October 2024, the average FICO credit score in the U.S. was 717 points, which is squarely in the good range. If your credit score is less than 670, it falls in either the fair or poor range — which is considered below average and may be considered subprime by lenders.

What is a bad VantageScore credit score?

VantageScore is another credit scoring model that pulls data from consumer credit reports to calculate a credit score. In the VantageScore model, a score between 300 and 660 is considered a subprime credit score, with scores below 500 deemed very poor.

The VantageScore model breaks down its credit score ranges as follows:

EXPAND

The average VantageScore credit score as of November 2024 was 702 — well within Vantage’s good credit score range.

Who determines my credit score?

FICO and VantageScore both monitor your credit usage and finances, and assign you a credit score based on their unique internal scoring model. However, it’s the issuer’s choice of which credit scoring agency they use to assess your creditworthiness for a product.

Factors that impact your credit score

Your credit score is based on the information in your credit report. Each of the three major credit bureaus (Equifax, Experian and TransUnion) builds a unique credit report based on how you use the various credit accounts under your name.

Here are the five factors that make up your credit score in the FICO model:

Credit score factors

- Payment history (35 percent)

-

Your payment history includes information about your track record and timeliness of payments on your credit accounts.

- Amounts owed (30 percent)

-

FICO looks at both the total amount owed across all your accounts and your credit utilization on revolving accounts. Your credit utilization ratio, or debt-to-credit ratio, is your current credit balance compared to the amount of credit available to you.

- Length of credit history (15 percent)

-

The length of your credit history is how long you’ve successfully maintained open credit accounts.

- Credit mix (10 percent)

-

This category considers the mix of credit types in your account. Lenders like to see that you can manage both revolving credit, like a credit card, and installment loans, like a car loan.

- New credit (10 percent)

-

New credit refers to how often you have applied for new lines of credit in the recent past. Those applications typically appear on your credit report as hard credit inquiries, which can temporarily lower your credit score.

Keep in mind

VantageScore uses similar factors but slightly different terminology and category weights. Under the VantageScore 4.0 model, the factors that affect your credit score are payment history, depth of credit, credit utilization, recent credit, balances and available credit. Among these, payment history, depth of credit and credit utilization are the most important — weighted at 41 percent, 20 percent and 20 percent of your score, respectively.

It’s possible to have a high credit score even if you are weak in one of the five factors. If you are relatively new to credit, for example, you might not have an extensive credit history. You may also have only one or two credit cards under your name, which means you won’t have much of a credit mix yet.

However, if you make on-time payments, keep your balances low and avoid applying for too much credit at once, you can still build and maintain a good credit score.

The impact of a bad credit score

Here are some of the unfortunate ways a bad score can impact you:

- Harder time getting credit approval: Lenders view borrowers with bad credit as a risk, which means they’re less likely to approve you for credit. Since banks and lending institutions typically have rigorous qualification standards for their products, getting approval for a loan or credit card can be difficult for anyone with a bad credit score. It’s important to note that many of the best cards require a good or excellent score.

- Higher interest rates and more restrictive terms on loans and credit cards: Some lenders have more lenient guidelines and will approve a borrower with bad credit for credit products. However, they’ll likely offset their risk by attaching a higher interest rate to the loan or credit card, meaning you’ll pay more in interest if you carry a balance.

- Higher insurance premiums: Most states allow home and auto insurance carriers to check your credit scores as part of their risk analysis. Your insurer may consider your bad credit score an indicator of higher risk overall and charge you a higher premium.

- Tougher time renting an apartment: Many landlords run background checks that include credit information on potential tenants. While this differs from a credit check performed by a lender, your landlord may be able to see your payment history, overdue bills and other information. Ultimately, landlords may be less likely to approve a lease for applicants with bad credit than applicants with good credit.

- Restricted career opportunities: With your written permission, it is legal in most states for an employer to review your credit report and use that information when making hiring decisions. Although some states have laws that restrict using credit information in the hiring process, other states don’t offer such protections.

- Utilities deposits: Utility companies can and do perform background checks on those who seek their services. If your credit history is poor, you may be required to pay a security deposit to establish utility services.

How to improve a bad credit score

Improving your credit score comes down to taking strategic action and consistently making strong financial decisions. Here are six steps you can take to improve your credit profile:

- Check your credit reports: Start by getting a free credit report from each of the three major credit bureaus at AnnualCreditReport.com, a government-authorized website. You can access these reports weekly. Dispute any errors and identify the negative information bringing down your score so you know where to focus your credit repair efforts.

- Avoid late payments: Since payment history makes up the largest portion of both your FICO and VantageScore scores, paying your bills on time is one of the best ways to build and maintain strong credit. Consider setting up automatic payments on your accounts to prevent late payments.

- Lower your credit utilization ratio: Your credit utilization ratio is another important factor in your overall credit score. A common rule of thumb is to keep your balances below 30 percent of your credit limit. However, according to 2024 data from Experian, the highest credit score achievers typically use less than 10 percent of their available credit.

- Become an authorized user: If your credit history is thin, or if you just want to improve your payment history, consider asking a friend or relative to add you as an authorized user on their credit card account. This strategy can be beneficial if the person you ask has an account with a high credit limit, low credit utilization and a strong history of timely payments. However, any negative marks or low credit score on that credit account could also affect your credit score, so make sure you only do this with someone you trust to use credit responsibly.

- Sign up for a secured credit card: Cardholders of secured credit cards open their accounts by putting down cash deposits as collateral, so their credit scores aren’t as important regarding the approval process. Because it’s much easier to get approved for a secured credit card than an unsecured one, these cards can be great tools for repairing or building credit. Many issuers even allow you to graduate to an unsecured credit card in their lineup once you’ve raised your score and shown that you can use your card responsibly.

- Look into credit builder loans: Credit cards aren’t the only financial tools available for those with bad or no credit history. If you don’t feel like a credit card is right for you, consider getting a credit builder loan instead. These types of loans work in reverse from traditional loans. Instead of the bank giving you a loan that you pay back little by little, the bank deposits your loan into a savings account or CD account and gives you access only after you’ve paid them back with routine monthly payments.

The bottom line

A bad credit score is considered to be a FICO credit score below 580 and a VantageScore lower than 601. If your credit isn’t where you would like it to be, remember that a bad credit score doesn’t have to weigh you down.

There are steps you can take to improve your credit, such as signing up for a flat-rate cash back card, a secured credit card or a credit card designed for bad credit. Then, be sure to make consistent on-time payments. Though it may take time for your score to improve, it’s worth the effort.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here